Top 10 DePIN Coins to Invest in 2025: A Complete Analysis for Real-World Blockchain Utility

Top 10 DePIN Coins : In 2025, Top 10 DePIN Coins are more than just another crypto trend—they’re reshaping how we interact with real-world infrastructure. DePIN, or Decentralized Physical Infrastructure Networks, are blockchain-powered ecosystems where users collectively build and maintain physical infrastructure like cloud storage, wireless networks, and GPU computing.

Unlike speculative tokens, DePIN projects focus on utility: providing essential services through decentralized architecture while rewarding contributors. As institutional focus gradually shifts toward utility-driven and sustainable projects, DePIN is carving out its role at the core of the next-gen Web3 ecosystem.

1. Chirp (CHIRP) – Pioneering Real-World Mapping on Sui

Source: DePIN Hub

Chirp is emerging as a leading DePIN project on the Sui blockchain, integrating decentralized telecom with play-to-earn elements. Its standout use case revolves around wireless mapping through its game “Kage,” which rewards users for contributing to real-time network coverage.

With over 40,000 users and 13,000 active devices, Chirp is not only growing—it’s building bridges between IoT, mobile telecom, and decentralized gaming. For investors eyeing small-cap gems with network traction and presale strength, CHIRP is an early mover in the DePIN x GameFi fusion.

2. Render (RNDR) – The GPU Powerhouse for Web3 Creators

Source: crypto economy

Render is one of the earliest and most successful use cases of DePIN in the GPU rendering space. It enables users to rent out excess GPU power for 3D rendering, video creation, and AI tasks—offloading costs and empowering creators across industries.

With an 80% gain in the past year and strong AI integrations, RNDR remains a favorite in the decentralized compute market. Despite being 70% below its all-time high of $13.60, it’s positioned well for long-term scalability, especially with the AI and metaverse sectors booming.

3. Top 10 DePIN Coins: BitTorrent (BTT) – Legacy P2P Tech Meets Web3

Source: decrypt

BitTorrent isn’t a newcomer, but its transition from a Web2 file-sharing legend to a Web3-powered DePIN project under TRON’s wing is worth noting. Its tokenized peer-to-peer protocol now rewards users for distributing bandwidth and file storage.

While its 1-year gain has been modest (~6%), BTT’s large user base and low entry barriers make it a stable pick for those looking to ease into the DePIN market. Trading at a deep discount from its ATH, BitTorrent still holds value in legacy meets blockchain plays.

4. Top 10 DePIN Coins : Filecoin (FIL) – The Decentralized Cloud Storage Titan

Source: bit2me

Filecoin is perhaps the most recognized name in decentralized cloud storage. The platform lets users rent out spare disk space and rewards them with FIL tokens, aligning economic incentives with decentralized data storage.

Despite a massive drop from its ATH of $237, its robust fundamentals and early mover advantage make it a cornerstone in many DePIN-aligned portfolios. The growing need for censorship-resistant storage solutions could drive renewed demand for Filecoin over the coming years.

5. Top 10 DePIN Coins : Theta Network (THETA) – Reinventing Video Infrastructure

Source: Binance.US

Theta’s model decentralizes video delivery by allowing users to share bandwidth and computing resources. With its dual-token system (THETA and TFUEL) and major backers like Sony and Samsung, Theta is an underappreciated player in the decentralized streaming space.

Though still down over 85% from its ATH, Theta has posted a 101% yearly gain, suggesting investor confidence is returning. Its blend of real utility, token incentives, and real-world partnerships makes it one of the best DePIN tokens to watch closely in 2025.

6. Top 10 DePIN Coins : MultiversX (EGLD) – The High-Speed Backbone of DePIN

Formerly known as Elrond, MultiversX offers a high-performance blockchain capable of supporting DePIN operations across sectors like DeFi, IoT, and even fraud detection. With 100,000 TPS and zk integrations, it offers the scalability and security DePIN platforms demand.

While EGLD’s price is still far from its ATH, the ecosystem continues to grow quietly behind the scenes. For those seeking infrastructure investments with multi-niche potential, MultiversX is a smart pick for long-term exposure.

7. Ocean Protocol (OCEAN) – The Data Market for a Tokenized Future

Source: Securities

Ocean Protocol makes it possible to tokenize, sell, and purchase datasets in a secure and decentralized manner. This is a crucial function in a world increasingly powered by data-hungry AI models and privacy concerns.

Its market cap is still relatively modest, and the token is down from its ATH, but the project’s relevance is growing. As both researchers and enterprises seek trustworthy, decentralized data exchanges, Ocean could see increased traction through 2025.

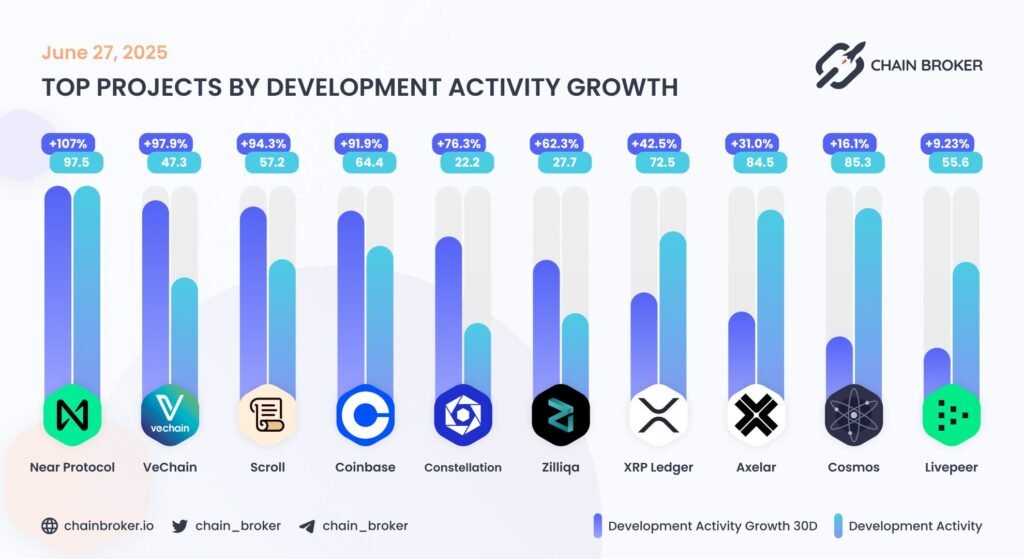

8. Livepeer (LPT) – Decentralized Video Infrastructure at Scale

Source: Chain Broker

Livepeer provides on-demand, low-cost video transcoding through a network of orchestrators—users who share their compute resources. It’s one of the more technical DePIN projects, yet vital to video-focused dApps and Web3 platforms.

LPT has posted a strong 76% annual gain, with signs of continued demand. For developers and investors betting on decentralized media, Livepeer offers a niche yet essential utility in the DePIN landscape.

9. Storj (STORJ) – Privacy-Focused, Sustainable Storage

Source: Trading View

Storj is often overshadowed by giants like Filecoin, but its privacy-first approach and full token circulation make it a compelling choice. It provides a low-barrier way to participate in decentralized storage, especially for users concerned with data privacy.

While its market cap remains small (~$72M), its fundamentals are intact. Trading at 87% below ATH, Storj represents one of the more asymmetric investment opportunities in the decentralized storage space.

10. World Mobile Token (WMT) – Bringing Internet Access to the Edge

Source: worldmobile

WMT takes a humanitarian approach to DePIN by building mobile internet access infrastructure in underserved regions using peer-to-peer nodes. Users who contribute through AirNodes and EarthNodes are rewarded with WMT.

Its 173% annual gain reflects the market’s growing recognition of inclusive infrastructure solutions. With real-world deployments in Africa and Latin America, WMT exemplifies how blockchain can serve both profit and purpose.

Bonus Projects to Keep on Your Radar

Several other Top DePIN projects also deserve attention:

- Helium (HNT): Wireless IoT network showing signs of technical recovery.

- Bittensor (TAO): AI-powered compute protocol with high growth momentum.

- Internet Computer (ICP): Layer-1 Web3 compute infrastructure showing steady accumulation.

- IOTA: Focused on feeless IoT transactions and smart cities.

- Akash Network (AKT): Decentralized cloud for AI compute.

- Arweave (AR): Immutable data storage with long-term archival features.

- AIOZ Network (AIOZ): CDN infrastructure for content and streaming platforms.

Why DePIN Coins Are Poised to Outperform in 2025

Source: Coinpedia

The Top 10 DePIN Coins aren’t just speculative assets—they offer scalable, real-world solutions for a digital-first world. From decentralized bandwidth to storage and mobile networks, they allow investors to diversify across critical infrastructure verticals.

As security, decentralization, and user-driven models become industry standards, DePIN projects are well-positioned to see increased adoption. Their unique incentive models also encourage long-term participation from users and developers alike.

Final Thoughts: Investing in the Infrastructure of the Future

The Top 10 DePIN Coins to Invest in 2025 reflect a broader trend toward real-world blockchain utility. Whether it’s Render powering AI video generation or WMT expanding internet access globally, these projects blend social impact with robust tokenomics.

For forward-looking investors, DePIN offers a balance of high conviction large caps (like Filecoin and RNDR) and asymmetrical upside in emerging projects (like Chirp and Storj). This sector stands at the intersection of infrastructure and innovation—an ideal zone for strategic crypto exposure.